What Mozart is to classical music, Warren Buffett is to investing. Really, the influence of the Oracle of Omaha, as he is called, cannot be overstated. The continued successes of Warren Buffet for more than half a century have helped him become one of the richest human beings on earth and accumulate quite a staggering net worth.

Even at the age of 93, the founder, chairman and CEO of Berkshire Hathaway Inc. continues to impart his wisdom and insights to investors around the world. Let’s be honest, most of us at that age will be lucky even to maintain our daily routines, let alone retain such an impact on the entire business industry.

Buffett’s investment philosophy, underpinned by the value investing style first put forward by Benjamin Graham and David Dodd in the 1920s, has stood the test of time. His wisdom and experience have guided investors through uncertain times in the stock market numerous times. While he will never directly recommend specific stocks, he is kind and generous with his advice; whilst wealthy beyond imagination, he also gives back to society.

Let’s explore his extraordinary life and career and how Buffett became one of the world’s richest people using his investing acumen to buy undervalued businesses that proved to be extremely profitable.

Here are all the details about the net worth and salary of Warren Buffett

What is the net worth of Warren Buffet?

As of 9 May 2024, Buffett is worth USD 134.5 billion, according to Forbes. That makes him the eighth richest person in the world behind Bernard Arnault, Jeff Bezos, Elon Musk, Mark Zuckerberg, Larry Ellison, Larry Page and Sergey Brin. Not bad for a self-made man. It translates to INR 11.23 lakh crore.

To put that figure further into perspective, it is larger than the GDP of countries like Iceland (USD 33.34 billion), Kenya (USD 104 billion), Luxembourg (USD 88.56 billion), Uzbekistan (USD 97.96 billion) and Sudan (USD 26.87 billion). The GDP data is from the International Monetary Fund.

What is Warren Buffett’s salary?

Warren Buffett’s salary at Berkshire Hathaway Inc. in 2022 was just USD 100,000. Interestingly, he has taken the same nominal amount as his salary for four decades. However, more than triple that amount was spent by the company on his security, according to this proxy statement.

Know all about Warren Buffett’s life and how he built his career

Early life and formative years

Born on 30 August 1930 in Omaha, Nebraska, it was clear from the beginning that Warren Edward Buffett was good with numbers and business concepts. An avid reader, he found a book called One Thousand Ways to Make $1000 at Omaha Public Library at the age of seven. According to the HBO documentary titled Becoming Warren Buffett, his book managed to spark a spirit of entrepreneurship in the young Warren, and he began to sell chewing gum, Coca-Cola bottles and magazines.

At the age of 12, his father, Howard Buffett, was elected to Congress, and he had to move to Washington. He applied for admission to Harvard Business School and was rejected. This rejection, however, turned out to be a blessing in disguise for Buffett.

As it turned out, Graham and Dodd, the two luminaries whose value investing philosophy was going to serve as bedrock for his future triumphs, taught at Columbia Business School. He wrote to them and was accepted. In 1951, he graduated from Columbia with a Master of Science degree in economics. His time at Columbia armed a young Buffett with skills and knowledge that proved immensely useful when he entered the world of business.

Career and early investment ventures

After graduating from Columbia, Buffett worked as an investment salesman at his father’s firm Buffett-Falk & Co. for three years and as a securities analyst at Graham-Newman Corp. from 1954 to 1956. However, these stints were only stepping stones in his journey towards his goal. It had always been clear to him what he wanted to become: a successful investor.

To that end, he established his own investment partnership called Buffett Partnership Ltd. in 1956. The company was invested using USD 100 from his own money and the rest of USD 105,000 was pooled from family and friends, including his sister. The investment principles he had learned on his own and later from Graham and Dodd began to pay rich dividends, and by 1962, he had grown to an astounding USD 7.2 million. Oh, and Buffett had shares worth over USD 1 million.

In 1965, Buffett, along with his new business partner Charlie Munger, acquired a struggling Massachusetts textile company called Berkshire Hathaway. He had begun buying its stocks in 1962, after realising that it was undervalued (he was applying the value investment principles). He believed that there would, in the future, be a tender offer, which would give him considerable profit.

When Seabury Stanton, the company’s then-owner, offered to buy back Buffett’s share in the company for USD 11.50 per share, Buffett agreed. But when the offer arrived, the price was lowered to USD 11.375, angering Buffett. In response, instead of buying, he opted to buy more shares to gain an ownership stake in the company and promptly fired Stanton.

Buffett spent years and a lot of money to revive the company’s core business (textiles) to insurance and further diversify its holdings. He later admitted that if he had switched the core business immediately to insurance instead of trying to prop up the textile business, the company would be twice as much now. So he estimates he lost USD 200 billion that way. Ouch!

In a 2010 interview with CNBC, Buffett explained, “Because Berkshire Hathaway was carrying this anchor, all these textile assets. So initially, it was all textile assets that weren’t any good. And then, gradually, we built more things on to it. But always, we were carrying this anchor. And for 20 years, I fought the textile business before I gave up. As instead of putting that money into the textile business originally, we just started out with the insurance company, Berkshire would be worth twice as much as it is now.”

“Yeah. This is $200 billion. You can — you can figure that — comes about. Because the genius here thought he could run a textile business,” he added self-depreciatingly.

Road to becoming a billionaire and the most profitable Warren Buffett investments

Now, with Berkshire Hathaway as his flagship, Buffett began applying the principles of value investing in earnest. We explain later what it means, but to make the long story short, Buffett’s goal was to search for undervalued assets and companies with growth potential. One fine example is Berkshire’s 1972 acquisition of See’s Candies.

The purchase was 300 per cent of book value, which essentially means that Buffett and Munger paid three times the value of the company according to its balance sheet. This was a bold, unprecedented investment, and the company cost them USD 25 million. Clearly, Buffett saw potential in the company’s business and according to his calculations, the company was undervalued. The product was good and there was strong brand recognition along with a loyal customer base.

A 2019 report in Business Standard states See’s Candies has delivered Berkshire 8,000 per cent returns. According to Buffett himself, the company has yielded USD 2 billion in income on a USD 25 million investment. Was the investment risky? It does sound incredibly risky to most of us if one is paying thrice the stated value of something. Not if you are Buffett and actually know what you are doing. See’s Candies was the first of Buffett’s “economic moats”, businesses with advantages over others.

Other notable purchases Berkshire and Buffett made include Government Employees Insurance Company (GEICO) and Dairy Queen. Both businesses are big names today. Initially, Buffett acquired a limited (and not ownership) stake in GEICO (he had been investing in the company since the 1950s), and in 1996, he acquired it whole — in other words, it became a wholly-owned subsidiary of Berkshire Hathaway. According to a case study by csinvesting.org, the initial investment of Berkshire in GEICO grew from USD 46 million to a stupefying USD 2.3 billion, which is what promoted Buffett’s decision.

An insurance company, GEICO, has been known for its catchy advertising and direct-to-consume sales model. In 2023, it was listed as one of America’s best insurance firms by Forbes.

Meanwhile, Dairy Queen, which Berkshire acquired in 1998, was known for its ice creams and fast-food products. It was an iconic brand but had not been able to capitalise on its full potential. Buffett saw a strength in Dairy Queen’s brand and a potential to unlock additional value. Additionally, he was also a fan of the company’s products.

In a 1997 letter to the Berkshire Hathaway shareholders, he joked. “Charlie [Munger] and I bring a modicum of product expertise to this transaction: He has been patronizing the Dairy Queens in Cass Lake and Bemidji, Minnesota, for decades, and I have been a regular in Omaha. We have put our money where our mouth is.”

Under Berkshire’s ownership, the brand invested extensively in marketing, product innovation and efficiency. The cost of the investment was USD 585 million. In 2022, the company’s annual sales alone were USD 457 billion, according to Forbes. The company operates in more than 20 countries, including China.

However, Buffett has not just been buying companies outright. He has also made huge investments in popular publicly traded companies like Coca-Cola, American Express, Wells Fargo, Fruit of the Loom and McDonald’s.

Riding on decades of astute investments, Warren Buffett became a billionaire in 1985. He was just 55. Today, he is worth well over USD 100 billion.

Warren Buffett’s investment philosophy explained

So what exactly is value investing — the strategy Buffett learned from Graham and Dodd and later refined and popularised? It basically revolves around the idea of buying businesses, stocks or other assets at less than what their fundamental or intrinsic value is. It does not mean buying at a discounted or temporarily lowered price, rather it means finding out business with strong fundamentals, good management and advantages over its competitors — all of which indicate they have long-term growth potential.

Value investing is also long-term investing. Buffett believes that when you buy shares in a company, it is a stake in the company, however small, and he has the capability of holding them for decades if he, of course, believes in the underlying value.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price,” wrote Buffett in his 1989 letter to the shareholders.

Buffett has also regularly spoken about being patient about investments and not getting swayed by hot topics and new trends or businesses that may seem attractive but are not run well or have bad fundamentals.

Much of what Buffett has taught and used has become popular wisdom in investing. For instance, investing in well-run businesses with strong fundamentals, competent management and competitive advantages are considered cornerstones of successful investing. Additionally, the key to Buffett’s investment philosophy is the concept of a ‘margin of safety’ that urges investors to buy assets at prices significantly below their intrinsic value.

Despite what he says, it is how he states things. Being arguably the most successful investor of all time, he has a down-to-earth demeanour and gives the most valuable and useful advice in a folksy way, as though he were chatting with a friend in a cafe. He wrote on his philanthropic pledge that his wealth is due to “a combination of living in America, some lucky genes, and compound interest.”

Besides his humongous successes over an entire lifetime, his advice boils down to the basics, and he always reminds you that investing is not rocket science and that anybody can be successful in this domain. Which, of course, is not true, but still, it’s confident-inducing to hear him say that.

Warren Buffett’s key investments through Berkshire Hathaway

According to Investors.com, here are Buffett’s key investments through his holding company Berkshire Hathaway Inc. along with the total number of shares:

- Bank of America: 1.03 billion shares

- Apple: 905.6 million shares

- Coca-Cola: 400 million shares

- Kraft Heinz: 325.6 million shares

- Occidental Petroleum: 248.1 million shares

- American Express: 151.6 million shares

- Chevron: 126.1 million shares

- Nu Holdings: 107.1 million shares

- Paramount Global: 63.3 million shares

- Citigroup: 55.2 million shares

How Warren Buffett spends his wealth

When it comes to billionaires, Buffett is an exception. No, not just because he is one of the few who became wealthy almost entirely from buying profitable businesses. He is unique because he lives a comfortable yet frugal life, particularly for a man of immense fortune. He has a modest lifestyle and most of his wealth is tied with Berkshire Hathaway’s holdings.

Properties

Warren Buffett has lived in the same house since 1958 when he bought it for a princely sum of USD 31,500. The five-bedroom 610.37 sq metres stucco house is located in his native Omaha, Nebraska. Though, as of 2024, the house is valued at USD 1.4 million.

And that’s just about it, really. Buffett owns no real estate besides his comparatively modest house. “I’m warm in the winter, I’m cool in the summer, it’s convenient for me. I couldn’t imagine having a better house,” said Buffett while speaking to the BBC in 2009.

Cars

While you would expect a billionaire to splurge freely on shiny and expensive luxury or sports cars, Buffett chooses functionality over flashiness, again. He owns a Cadillac XTS that he bought in 2006 on the recommendation of none other than Mary Barra, the CEO of General Motors, who waxed eloquently about the CTS model in a conversation. Buffett sent his daughter Susie Buffett to a local Cadillac dealership, where a saleswoman convinced her to buy an XTS instead. The price of this car starts from USD 27,131. The story was recorded on a GM blog, whose archived copy can be accessed here.

Other assets

Buffett owns precious few known assets besides his investments, house and car. We do know he has a collection of — wait for it — 22 ukuleles. Clearly, he loves the musical instrument too much. According to Yahoo Finance, Buffett used a USD 20 flip phone until 2020, though by then he had heavily invested in Apple over four years. He then purchased an iPhone 11. Apple is still Berkshire Hathaway’s largest holding in terms of money invested, though not in terms of number of shares.

Warren Buffett’s philanthropic efforts

I might have included Buffett’s philanthropy in the above section since this is what he has spent his money on. For instance, he was the richest man in the world in 2008 with a net worth of USD 62 billion. The following year, Buffett’s net worth came down to USD 37 billion. As per a Reuters report from 2010, he donated USD 1.93 billion to charities, which was just the newest phase of the decision made by him and his long-time friend and Microsoft co-founder Bill Gates to donate a majority of their wealth for the betterment of humanity as a whole. According to his Forbes profile, he has given away USD 56 billion. And that is how we come to The Giving Pledge.

The Giving Pledge

The Giving Pledge was an initiative launched by Buffett and Gates in 2010. It calls upon the wealthiest people across the world to donate most of their money to philanthropy, either during their lifetime or after through wills. The motive of the initiative was to cultivate a culture of giving among the ultra-rich and to hopefully solve some of the major issues plaguing the world like poverty, unemployment, climate change, lack of education and lack of proper healthcare. Both Buffett and Gates have committed 99 per cent of their wealth to charitable causes.

Currently, notable signatories to The Giving Pledge include Elon Musk of Tesla and X and Mark Zuckerberg of Meta. From India, the pledgers include Azim Premji of Wipro and Nikhil Kamath of Zerodha.

Other interesting facts to know about Warren Buffet

- Warren Buffett purchased his first stock when he was just 11 and filed his first tax return at 13, according to Forbes.

- Buffett is known as the “Oracle of Omaha”.

- He is generous with his advice and is known for his iconic aphorisms like: “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No.1.”

- He avoids tech stocks since he does not understand technology much. Instead, he prefers investing in companies with straightforward business models and predictable cash flows. That said, he is heavily invested in Apple.

- Buffett is an avid Coca-Cola drinker and a longtime shareholder of the company.

- He is a Presidential Medal of Freedom recipient.

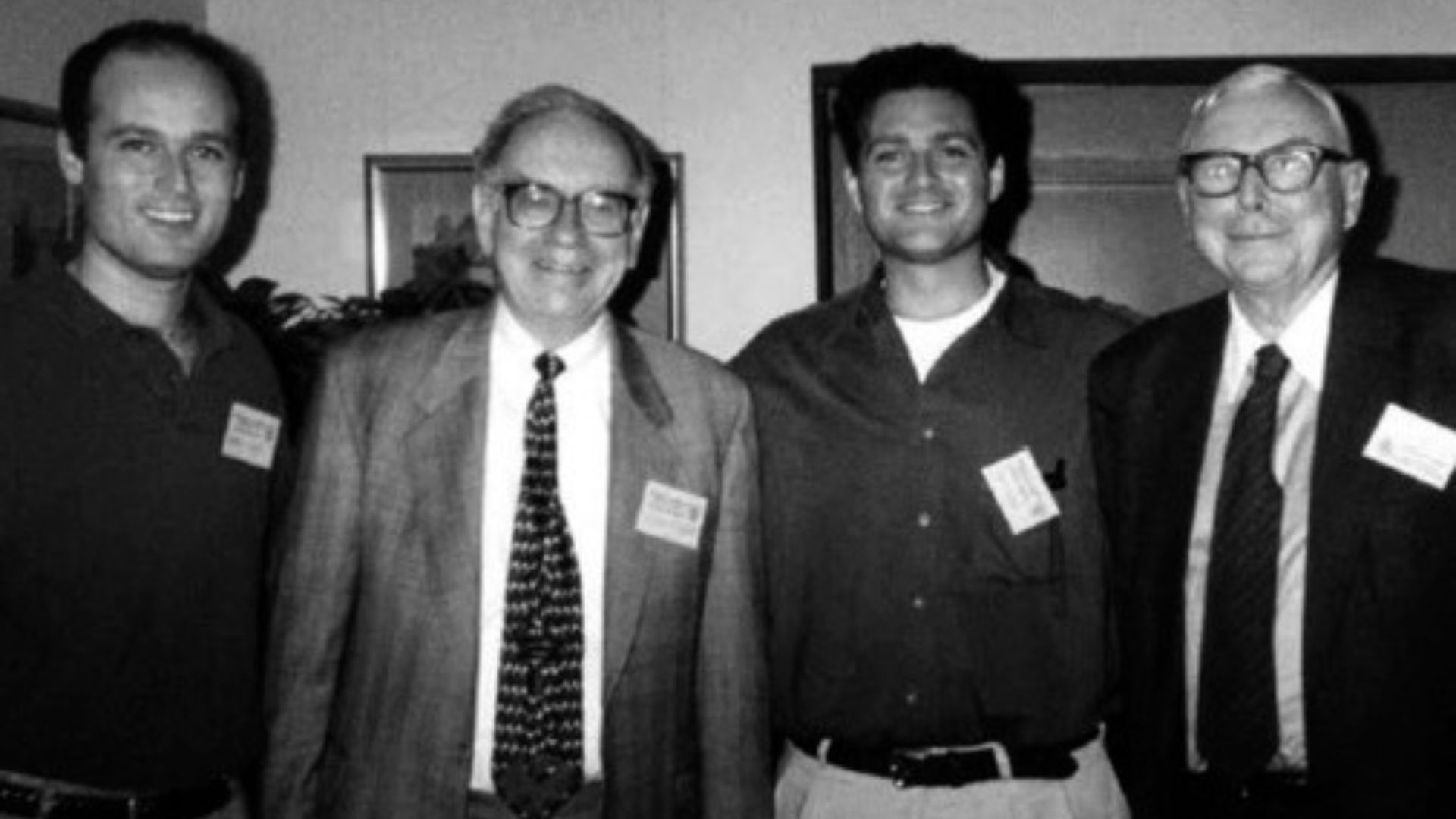

(Hero and Featured image: Courtesy of Gates Foundation)

Frequently Asked Questions (FAQs)

-What is Warren Buffett’s net worth as of today?

The net worth of Warren Buffett is USD 134.5 billion, as of 13 May 2024.

-Was Warren Buffett ever the richest man in the world?

Yes, he was listed as the richest man by Forbes in 2009. However, he lost the title to his friend Bill Gates the following year, because he donated billions of dollars to charity.

-How did Warren Buffett get his money?

Warren Buffett amassed his wealth primarily through investing in undervalued companies and businesses with strong fundamentals.

-Who are the world’s top five richest men?

The top five richest men in the world in order are Bernard Arnault, Jeff Bezos, Elon Musk, Mark Zuckerberg and Larry Ellison.

-Who is the top businessman in the world?

Bernard Arnault is the richest man in the world, as of 13 May 2024, and thus the best and most successful businessman.

-Who is the richest man on earth in 2024?

Bernard Arnault, the CEO of LVMH Moët Hennessy Louis Vuitton, is the richest man, as of May 2024. His net worth is USD 220 billion.